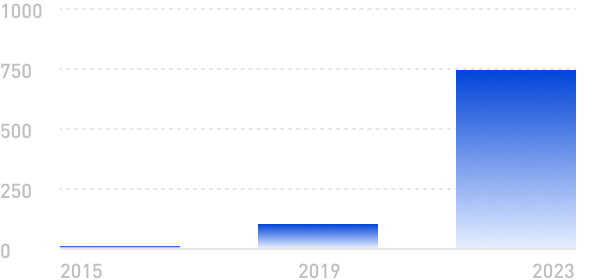

Total

Total market value growth

2015

$3 Billion

2019

$113 Billion

2023

$749 Billion

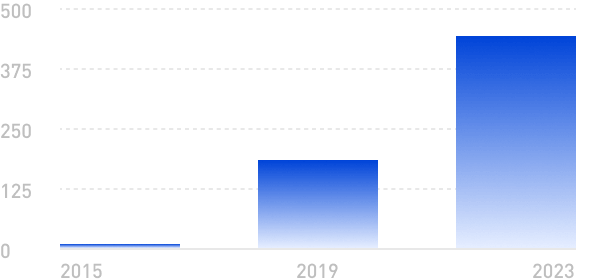

DeFi

DeFi Market Growth

2020

$9 Billion

2021

$212 Billion

2023

$450 Billion

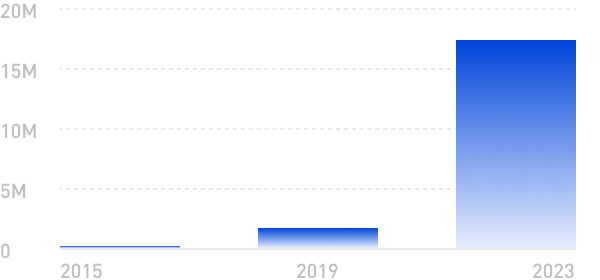

EVM

EVM independent active addresses

2017

10 K

2020

100 K

2023

17 Million

Web3 is the third generation of the Internet of Value, created, owned and controlled by users and distributed through smart contracts. Web3 is the third generation of the Internet of Value, created and controlled by users and distributed through smart contracts. 10 years of development have brought Web3 from niche to mass!

PRODUCT DISPLAY

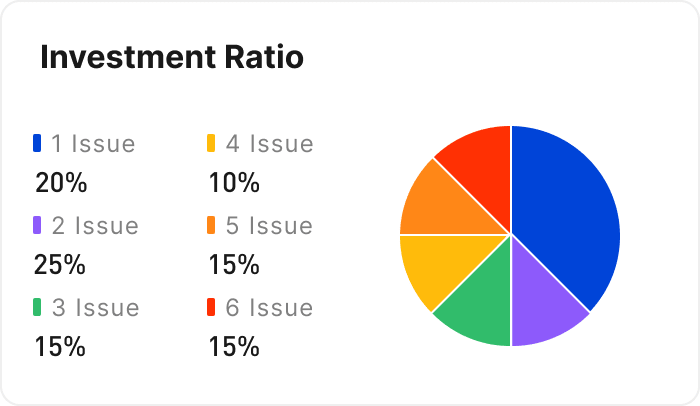

INDUSTRY INVESTMENTS

Getting Involved in the Web3

and DeFi World

It's Never Been Easier

Capture stable returns and long-term value returns

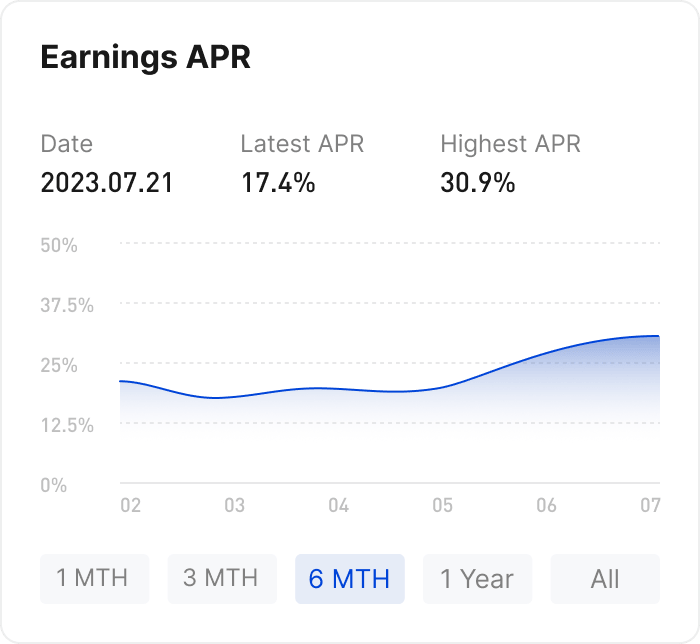

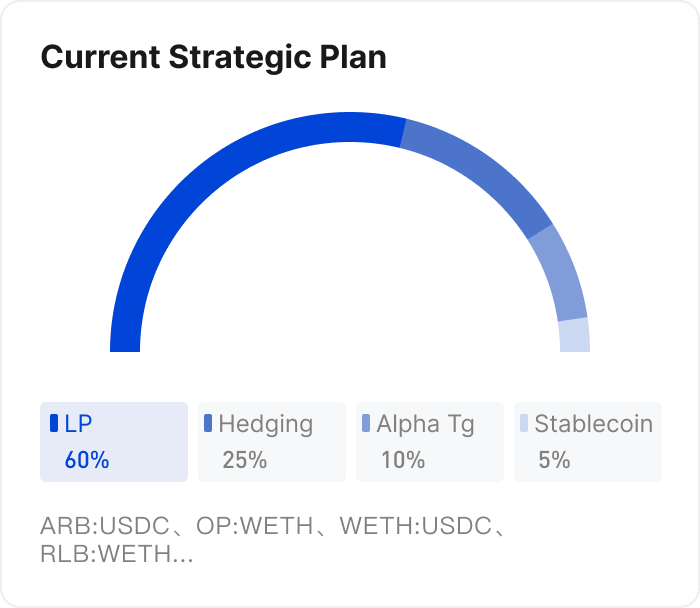

DeFi Yield

Find the best revenue portfolio strategy in the market and earn trading fees, interest or governance incentives as a stable return by providing liquidity to the DeFi market, while also capturing a portion of the growth benefits of high-value DeFi protocols.

DeFund

Investing in primary and secondary markets, we select high quality targets for equity and token investments through partnerships with industry headline funds to capture the highest industry growth returns.

Index Invest

Select liquidity-quality mainstream cryptocurrencies to invest in based on liquidity, project fundamentals, future growth, and other metrics to gain long-term growth benefits from the industry.

Finding Partners

Learning

Capturing Wealth

Research

Disclosure of internal investment research and analysis reports

Share

Sharing and analysis of hot tracks and projects

Activity

Formation of regular communication activities

Opportunity

Opportunities to know the market cycle earlier

SERVICES USED

Become a decentralized community with

happiness and rich

Web3 is the third generation of the Internet of Value, created, owned and controlled by users and distributed through smart contracts. Web3 is the third generation of the Internet of Value, created and controlled by users and distributed through smart contracts. 10 years of development have brought Web3 from niche to mass!

PRODUCT DISPLAY

INDUSTRY INVESTMENTS

Getting Involved in the Web3 and DeFi World It's Never Been Easier

Capture stable returns and long-term value returns

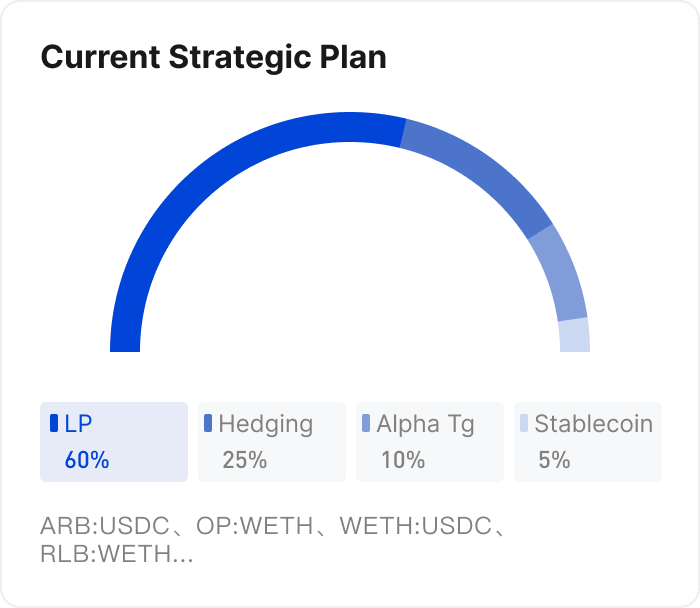

DeFi Yield

Find the best revenue portfolio strategy in the market and earn trading fees, interest or governance incentives as a stable return by providing liquidity to the DeFi market, while also capturing a portion of the growth benefits of high-value DeFi protocols.

DeFund

Investing in primary and secondary markets, we select high quality targets for equity and token investments through partnerships with industry headline funds to capture the highest industry growth returns.

Index Invest

Select liquidity-quality mainstream cryptocurrencies to invest in based on liquidity, project fundamentals, future growth, and other metrics to gain long-term growth benefits from the industry.

Finding Partners

Learning

Capturing Wealth

Research

Disclosure of internal investment research and analysis reports

Share

Sharing and analysis of hot tracks and projects

Activity

Formation of regular communication activities

Opportunity

Opportunities to know the market cycle earlier